Have you ever heard of a pyramid scheme? It’s one of those terms that gets thrown around a lot, but do you really know what it means? In simple terms, a pyramid scheme is a business model that promises participants huge profits for recruiting others into the scheme rather than selling actual products or services. It sounds too good to be true, right? Well, that’s because it usually is.

Let me break it down for you. In a pyramid scheme, you’re asked to invest money upfront to become a member. Then, you’re encouraged to recruit other people to join as well. As more people join, you’re promised a cut of their investments. The problem is, the only way to make money is if you can continue recruiting new members indefinitely. Eventually, the scheme collapses as it becomes impossible to sustain the recruitment cycle. So, while the people at the top may make some profits, the majority of participants end up losing their investments. In my upcoming article, I’ll delve deeper into the mechanics of pyramid schemes and how to identify them to protect yourself from falling victim to such scams. Stay tuned!

Understanding Pyramid Schemes

Definition of a Pyramid Scheme

A pyramid scheme is a fraudulent business model that involves recruiting participants and making money primarily through the recruitment of others, rather than from the sale of a legitimate product or service. It is a form of financial fraud that relies on the constant recruitment of new members to sustain the scheme. Participants are often promised high returns on their investment or entry fee, but the scheme is inherently unsustainable and eventually collapses, leaving the majority of participants with financial losses.

Origins of Pyramid Schemes

The origins of pyramid schemes can be traced back to various historical periods and cultures. While the specific origins are difficult to pinpoint, there are instances of this fraudulent business model occurring throughout history. The concept of a pyramid scheme has evolved over time, adapting to changing economic conditions and exploiting the vulnerabilities of individuals seeking financial gain.

Characteristics of Pyramid Schemes

Pyramid schemes share several distinctive characteristics that set them apart from legitimate business models. One of the key features is the emphasis on recruitment over product sales. In a pyramid scheme, the primary focus is on bringing in new members and expanding the network, rather than selling a genuine product or service. Additionally, pyramid schemes often lack a legitimate and sustainable source of revenue, relying solely on the continuous influx of new participants to generate profits. They also typically involve multiple levels of participants, with those at the top benefiting the most and those at the bottom facing the greatest financial risks.

How Pyramid Schemes Work

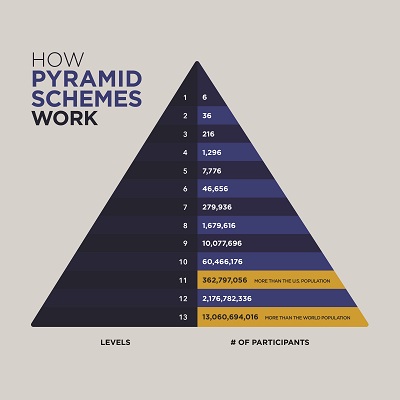

Pyramid schemes typically begin with an initial promoter or a small group of individuals at the top of the structure. These individuals recruit others to join the scheme, who then recruit even more participants. As new members are recruited, they are required to pay an investment or entry fee, which is often a significant amount of money. The money collected from these entry fees is then distributed to those at the top of the pyramid as payouts or returns on their investment. This pattern continues as the scheme expands, with each level of participants recruiting new members and receiving a portion of their entry fees.

Recruitment and Downline

Recruitment is a vital aspect of pyramid schemes as it fuels the growth and profitability of the scheme. Participants are often encouraged to recruit friends, family, and acquaintances to join the scheme, promising them significant financial rewards in return. As new members are recruited, they become part of the “downline” of the individual who recruited them. This downline structure allows for the cascade effect, where each participant aims to recruit as many new members as possible to maximize their potential profits.

The Promise of High Returns

One of the most enticing aspects of pyramid schemes is the promise of high returns on investment. Participants are often lured in by the prospect of quick and easy money, with promises of doubling or even tripling their initial investment within a short period. However, these claims are often false and misleading, designed to entice individuals into joining the scheme. Pyramid schemes should not be confused with legitimate investment opportunities or business models, as they rely on unsustainable recruitment practices rather than the sale of products or services.

Unsustainability of Pyramid Schemes

Pyramid schemes are fundamentally unsustainable due to their reliance on an endless supply of new participants. As the scheme continues to grow, recruitment becomes increasingly difficult, leading to a saturation point where there are no more individuals left to recruit. This exponential growth and eventual saturation inevitably lead to the collapse of the pyramid scheme, causing significant financial losses for the majority of participants who joined later in the scheme’s lifespan.

Legal Issues and Pyramid Schemes

Pyramid schemes are illegal in most countries due to their deceptive and fraudulent nature. Governments and regulatory bodies have implemented measures to combat pyramid schemes and protect individuals from falling victim to them. Penalties for participating in or promoting pyramid schemes can be severe, including fines and imprisonment. However, despite these legal measures, pyramid schemes continue to exist, often operating under the guise of legitimate business opportunities or investment schemes.

Examples of Pyramid Schemes

Over the years, numerous pyramid schemes have made headlines and caused substantial financial losses for participants. One notable example is the infamous “Bernie Madoff Ponzi Scheme” that defrauded investors of billions of dollars. Another well-known pyramid scheme is the “TelexFree” case, which involved a fraudulent telecommunications company that promised high returns on investments but ultimately collapsed, leaving thousands of participants with significant financial losses. These examples serve as a reminder of the dangers and risks associated with pyramid schemes.

Protecting Yourself from Pyramid Schemes

To protect yourself from pyramid schemes, it is crucial to be aware of the red flags and warning signs. Be skeptical of any opportunity that promises unusually high returns with little effort or risk. Research and investigate any business or investment opportunity thoroughly before committing your money. Be cautious of pressure tactics and aggressive recruitment techniques, as pyramid schemes often rely on these strategies to lure individuals in. Finally, consult with financial professionals or regulatory authorities if you suspect a business opportunity or investment scheme may be a pyramid scheme.

Conclusion

Understanding the risks associated with pyramid schemes is essential to protect yourself and others from falling victim to these fraudulent schemes. By staying vigilant, promoting ethical business practices, and educating others about the characteristics and dangers of pyramid schemes, we can contribute to a safer and more honest business environment. Remember, if an opportunity sounds too good to be true, it probably is, and it is crucial to exercise caution and make informed decisions when it comes to your finances.