Hey there! Have you ever heard of pyramid schemes? If not, don’t worry, because I’m here to help you understand what they are and how they work. Pyramid schemes can be a bit confusing, but with a little bit of knowledge, you’ll be able to protect yourself and others from falling victim to these deceptive practices.

So what exactly is a pyramid scheme? In my upcoming article, I’ll explain the definition of a pyramid scheme and break down how it operates. You’ll learn about the structure of a pyramid scheme, the promises they make to lure people in, and the dangerous consequences they can have for individuals and communities. By the end, you’ll have a solid understanding of what to look out for and how to spot a pyramid scheme. Stay tuned to delve deeper into the world of pyramid schemes and become more knowledgeable about this important topic.

1. What is a Pyramid Scheme?

Definition of a pyramid scheme

A pyramid scheme is a fraudulent business model that involves the recruitment of individuals, who are incentivized to bring in more participants in order to earn money. It is often disguised as a legitimate business opportunity, promising high returns on investment with minimal effort. However, the primary source of profit in a pyramid scheme does not come from the sale of products or services, but rather from the recruitment of new members.

Characteristics of a pyramid scheme

There are several key characteristics that define a pyramid scheme:

-

Recruitment-driven profits: The primary focus of a pyramid scheme is on bringing in new members rather than selling actual products or services. Participants are typically required to invest a certain amount of money upfront and earn commissions based on their ability to recruit others.

-

Hierarchical structure: Pyramid schemes are organized in a hierarchical structure, with the person at the top, known as the “recruiter” or “sponsor,” earning the most money. As new members are recruited, they form a new tier beneath the initial participants, creating a pyramid-like structure.

-

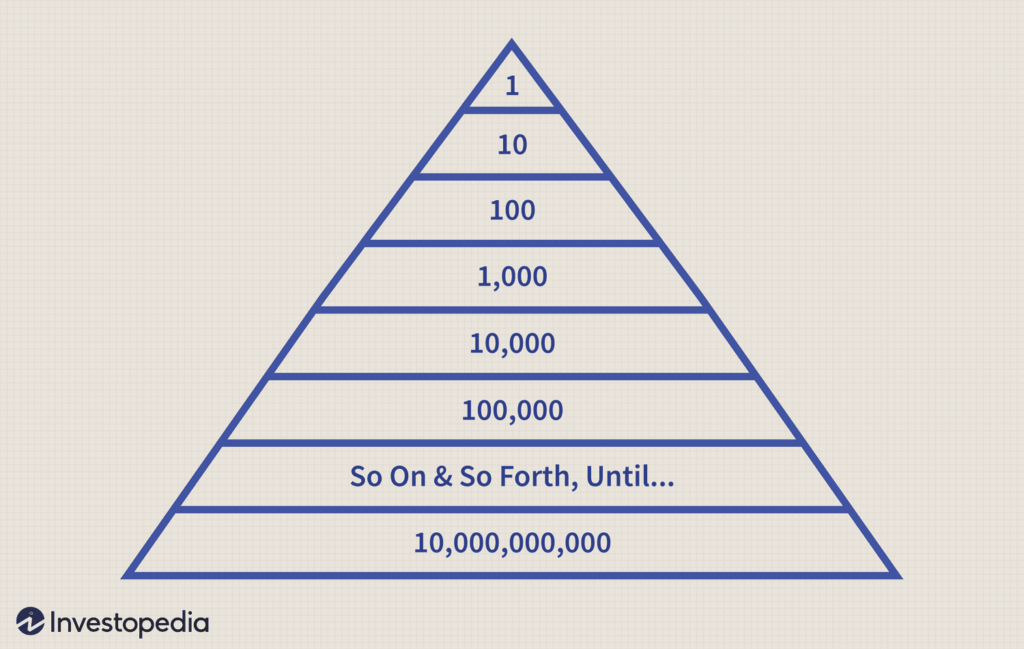

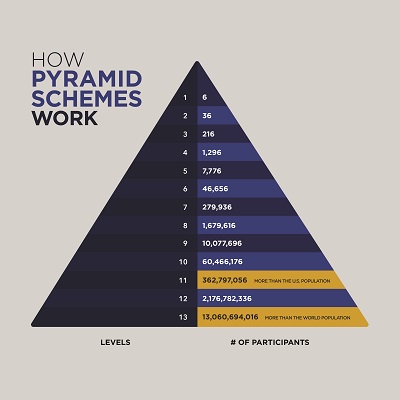

Unsustainable growth: Pyramid schemes rely on a constant influx of new members to sustain their operations. Eventually, the pool of potential recruits becomes depleted, leading to a collapse of the scheme. This means that the majority of participants will inevitably lose their money.

-

Lack of tangible products or services: While pyramid schemes often claim to offer products or services, the focus is primarily on recruitment rather than the sale of these offerings. The products or services may be of low quality or nonexistent altogether, serving merely as a disguise for the illegal scheme.

2. How Does a Pyramid Scheme Work?

Recruitment process in a pyramid scheme

In a pyramid scheme, the recruitment process plays a crucial role. Participants are encouraged to recruit friends, family members, and acquaintances by promising them significant financial gains. The initial investment required to join the scheme is often presented as a small fee or a purchase of starter kits or inventory.

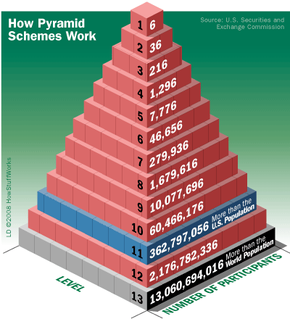

Levels and tiers in a pyramid scheme

As new recruits join the scheme, they form a new level or tier beneath the existing participants. Each tier consists of individuals who have been recruited by those directly above them. Participants are typically incentivized to recruit more individuals, as they earn a percentage of the recruits’ investments or earnings.

Promise of high returns

One of the main tactics used by pyramid schemes is the promise of high returns on investment. Participants are enticed by the idea of making large sums of money with little effort or time commitment. However, these promises are often unrealistic and unsustainable, as the scheme relies solely on the recruitment of new members rather than the sale of products or services.

3. Identification and Warning Signs

Recognizing a pyramid scheme

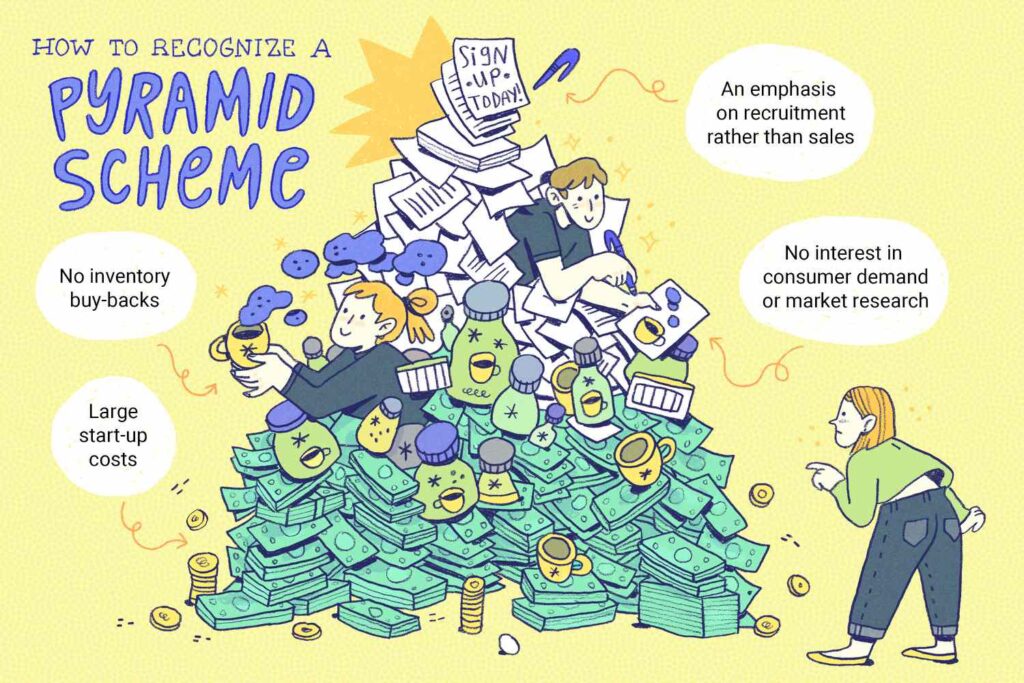

Identifying a pyramid scheme can be challenging, as they often disguise themselves as legitimate business opportunities. However, there are several warning signs to watch out for:

-

Emphasis on recruitment: If the primary focus of the opportunity is on recruiting new members rather than selling products or services, it is likely a pyramid scheme.

-

Lack of product or service value: If the products or services offered by the scheme have little to no value, or if they are of low quality, it is a clear indication of a pyramid scheme.

-

Pressure to invest or recruit: Pyramid schemes often use high-pressure tactics to convince individuals to invest money or recruit others. They may create a sense of urgency or play on emotions to manipulate potential participants.

Common tactics used by pyramid schemes

Pyramid schemes employ various tactics to lure individuals into joining. Some common tactics include:

-

Promise of quick and easy money: Pyramid schemes often entice potential participants with the promise of quick financial gains. They may claim that little effort is required to achieve significant profits.

-

Manipulative recruitment strategies: Pyramid schemes target vulnerable individuals and use psychological manipulation techniques to convince them to join. They may exploit personal relationships or use emotional appeals to persuade individuals to invest.

-

High-pressure sales techniques: Pyramid schemes frequently use high-pressure sales tactics to convince potential participants to invest their money. They may create a sense of urgency or fear of missing out on a lucrative opportunity.

Red flags to watch out for

To protect yourself from falling victim to a pyramid scheme, it is essential to be aware of the red flags associated with such schemes:

-

Unusually high investment requirements: Pyramid schemes often require participants to invest a significant amount of money upfront. If the investment amount seems excessively high or disproportionate to the promised returns, it is a warning sign.

-

Lack of transparency: Legitimate businesses provide clear and transparent information about their products, services, and compensation plans. If a scheme is unwilling to provide detailed information or evades questions, it is likely a pyramid scheme.

-

Focus on recruiting friends and family: Pyramid schemes often encourage participants to recruit their friends and family members. If you are being pressured to recruit people close to you, it is a strong indication of a pyramid scheme.

4. Legal Aspects and Regulations

Laws and regulations surrounding pyramid schemes

Pyramid schemes are illegal in many countries because they exploit individuals and rely on the deceptive recruitment of new members. Governments have enacted laws and regulations to protect consumers from these fraudulent schemes. The specific laws vary from country to country, but they generally define pyramid schemes as illegal and impose penalties on those involved in promoting or participating in such schemes.

Enforcement by authorities

Government authorities, such as the Federal Trade Commission (FTC) in the United States, play a crucial role in identifying and prosecuting pyramid schemes. These agencies work to educate the public about the dangers of these schemes and investigate complaints filed by affected individuals. When pyramid schemes are identified, authorities take legal action to enforce the applicable laws and hold the responsible parties accountable.

Legal consequences and penalties

Engaging in a pyramid scheme can have severe legal consequences. Individuals involved in promoting or participating in pyramid schemes may face criminal charges, fines, and even imprisonment. Additionally, participants may be required to repay any profits earned from the scheme. It is crucial to understand the legal implications of involvement in a pyramid scheme and to avoid participating to protect yourself from potential legal trouble.

5. Impact on Participants

Negative effects on participants’ financial well-being

Pyramid schemes can have devastating effects on participants’ financial well-being. Many individuals invest their hard-earned money into these schemes, hoping to make a profit. However, the vast majority of participants lose their money, as the scheme is designed to benefit only those at the top of the pyramid. Participants may find themselves financially ruined, struggling to recover from the losses incurred.

Psychological manipulation in pyramid schemes

Pyramid schemes often utilize psychological manipulation techniques to exploit individuals. Participants may experience feelings of guilt, shame, and embarrassment when they are unable to recruit enough people or fail to earn the promised returns. These schemes prey on the vulnerability and desire for financial security, causing immense psychological distress and damage to participants’ self-esteem.

Social and relationship impact

Participating in a pyramid scheme can have a significant impact on relationships and social connections. Friends and family members who are recruited may feel deceived, leading to strained relationships. Additionally, the scheme’s hierarchical structure can result in tension and jealousy among participants, further damaging interpersonal relationships. The negative consequences of participating in a pyramid scheme can extend beyond financial loss, affecting participants’ personal lives as well.

6. Famous Pyramid Scheme Cases

Notable examples of pyramid scheme scams

Throughout history, there have been several high-profile pyramid scheme cases that have garnered significant attention. One such case is the infamous Bernie Madoff Ponzi scheme, which defrauded investors out of billions of dollars. Another notable pyramid scheme is the OneCoin scam, which swindled investors out of billions before its collapse in 2017.

Case studies and outcomes

The Bernie Madoff Ponzi scheme was one of the largest financial frauds in history. Madoff operated a legitimate investment firm but used new investors’ funds to pay existing investors, creating the illusion of high and consistent returns. The scheme collapsed in 2008 when investors requested withdrawals, and Madoff was sentenced to 150 years in prison.

The OneCoin scam, led by Ruja Ignatova, promised investors massive returns on investment in a cryptocurrency that never existed. Ignatova and her associates managed to attract billions of dollars from unsuspecting investors before the scheme unraveled. Several individuals involved in the scheme have been arrested and charged with various crimes.

These high-profile cases serve as cautionary tales, highlighting the devastating consequences of participating in pyramid schemes.

7. Differences Between Pyramid Schemes and Multi-Level Marketing

Defining multi-level marketing (MLM)

Multi-level marketing (MLM) is a legitimate business model in which individuals earn money through the direct sale of products or services, as well as through the recruitment of a downline of distributors. Unlike pyramid schemes, MLMs focus on product sales rather than recruitment as the primary source of income.

Key distinctions between pyramid schemes and MLM

While both pyramid schemes and MLMs involve recruitment and the formation of a hierarchical structure, there are important distinctions between the two:

-

Emphasis on product sales: MLMs place a significant emphasis on the sale of products or services. Distributors earn commissions on their sales, rather than solely relying on recruitment. In contrast, pyramid schemes primarily generate income from recruitment.

-

Legitimate products or services: MLMs offer legitimate products or services, which provide value to consumers. Participants are encouraged to sell these products to customers who genuinely want them. Pyramid schemes often have little to no real products or services of value.

-

Income sources: In MLMs, participants can earn income from their personal sales and the sales of their downline. Pyramid schemes derive income from recruitment only, with little or no emphasis on product sales.

It is essential to differentiate between pyramid schemes and legitimate MLMs to protect oneself from potential financial harm.

8. Protecting Yourself from Pyramid Schemes

Practical tips to avoid falling for pyramid schemes

To protect yourself from falling victim to a pyramid scheme, consider these practical tips:

-

Educate yourself: Learn about the characteristics of pyramid schemes and the warning signs. Understanding how these schemes operate can help you identify and avoid them.

-

Research companies and opportunities: Thoroughly research any company or investment opportunity before committing your money. Look for reviews, consumer complaints, and information from credible sources.

-

Consult with professionals: Seek advice from financial advisors, lawyers, or trusted experts who can provide objective opinions on potential investments or business opportunities.

-

Be skeptical of promises: Be wary of any opportunity that promises quick and easy money with minimal effort or risk. Remember the adage, “If it sounds too good to be true, it probably is.”

Researching and verifying investment opportunities

When considering an investment opportunity, take the following steps to ensure its legitimacy:

-

Conduct background checks: Research the company and its founders to determine their credibility and track record. Look for any legal issues or controversies associated with the company.

-

Read the fine print: Carefully review all contracts, agreements, and terms and conditions associated with the investment opportunity. Pay attention to compensation plans and understand how earnings are generated.

-

Seek independent verification: Consult independent third parties, such as financial analysts or industry experts, to validate the legitimacy of the investment opportunity.

-

Trust your instincts: If something feels off or too good to be true, trust your gut instinct. It is better to err on the side of caution than to fall victim to a fraudulent scheme.

9. Reporting and Seeking Help

How to report a pyramid scheme

If you suspect that you have encountered a pyramid scheme or have been scammed, it is important to report it to the appropriate authorities. Contact your local law enforcement agency, consumer protection agency, or the regulatory body responsible for overseeing financial services in your country. Provide them with all relevant information and documentation to assist in their investigation.

Resources to seek assistance and support

If you have been victimized by a pyramid scheme, there are resources available to provide assistance and support. Reach out to local organizations that specialize in consumer protection, fraud prevention, or financial counseling. They can provide guidance, advice, and resources to help you recover from the experience.

10. Conclusion

Understanding pyramid schemes is crucial for safeguarding your financial well-being. These fraudulent schemes prey on people’s desires for quick wealth and financial security, often leaving them devastated and financially ruined. By familiarizing yourself with the warning signs, red flags, and key distinctions between pyramid schemes and legitimate MLMs, you can protect yourself and make informed decisions regarding potential business opportunities.

Remember to prioritize financial literacy, skepticism, and due diligence when evaluating investment opportunities. By equipping yourself with knowledge and critical thinking skills, you can avoid falling victim to pyramid schemes and protect your hard-earned money.