In today’s article, we are going to talk about an important topic that concerns many people: MLM companies to avoid. We all want to make smart choices when it comes to our financial investments, and getting involved with the wrong MLM company can have serious consequences. Therefore, it is crucial to be informed and aware of the potential risks involved. With that in mind, we will be highlighting five MLM companies that you should steer clear of, providing you with the knowledge necessary to protect yourself and your hard-earned money. So, let’s delve into this insightful discussion together.

Pyramid Scheme: Ponzi Scheme

Definition

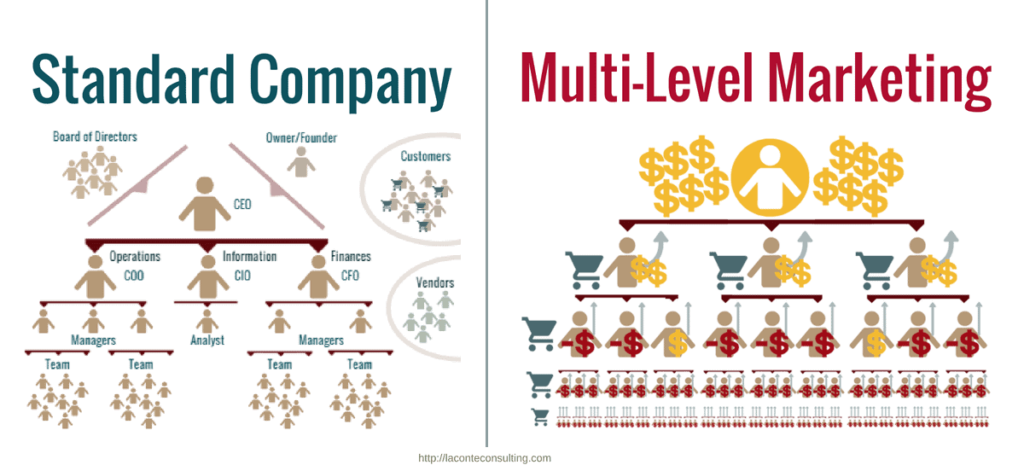

A pyramid scheme, also known as a Ponzi scheme, is a fraudulent business model that recruits members by promising them high profits for enrolling others into the scheme. The primary focus lies on recruiting new members and collecting their enrollment fees, rather than selling actual products or services. As the scheme grows, the monetary contributions from new recruits are used to pay off earlier participants, creating the illusion of profitability. Eventually, the scheme collapses, leaving those at the bottom with substantial financial losses.

Warning signs

It’s important to recognize the warning signs of a pyramid scheme to protect yourself from becoming a victim. Here are some key indicators:

-

Lack of genuine customers: Pyramid schemes typically lack a legitimate customer base or demand for their products. The main source of revenue stems from enrolling new members, rather than selling products to external consumers.

-

High prices for low-quality products: Pyramid schemes often sell overpriced products of questionable value or quality. These products serve as a cover for the illegal scheme and disguise the true nature of the business.

-

Negative reviews and complaints: Check online reviews and consumer complaints about the company. If there is a consistent pattern of dissatisfaction, it may indicate a pyramid scheme.

-

Product saturation in the market: Pyramid schemes often flood the market with their products, saturating it with an excessive supply. This saturation makes it challenging for participants to sell the products and recover their initial investments.

Examples of MLM companies that resemble pyramid schemes

While not all multi-level marketing (MLM) companies are pyramid schemes, there are some notorious examples that have faced legal scrutiny and controversy due to their business practices. Some MLM companies that have been likened to pyramid schemes include:

-

Herbalife: This nutritional supplement company faced allegations that it operated as a pyramid scheme, resulting in a $200 million settlement with the Federal Trade Commission in 2016.

-

Amway: As one of the largest MLM companies in the world, Amway has faced various legal battles and accusations of being a pyramid scheme throughout its history.

-

ACN Inc: This telecommunications company has been subjected to legal investigations and class-action lawsuits, accused of operating as a pyramid scheme.

-

Vemma: Vemma, a health and wellness MLM company, was shut down by the FTC in 2015 for operating as an illegal pyramid scheme.

-

LuLaRoe: LuLaRoe, a clothing MLM company, faced multiple lawsuits and accusations of being a pyramid scheme, leading to substantial financial losses for many of its consultants.

It is essential to research thoroughly and exercise caution before getting involved with any MLM company to avoid falling victim to a potential pyramid scheme.

Poor Product Quality or Value

Lack of genuine customers

One of the major red flags of a pyramid scheme is the absence of a genuine customer base. Instead of selling products to external consumers, the focus primarily lies on recruiting new members into the scheme. This lack of customer demand can indicate that the MLM company is operating as a pyramid scheme, with the emphasis on financial recruitment rather than the quality or value of their products.

High prices for low-quality products

A telltale sign of a pyramid scheme is the practice of selling overpriced products that offer little to no real value. These products often serve as a pretext to disguise the illegal scheme, giving the appearance of a legitimate business. However, upon closer inspection, the products are often of subpar quality compared to similar items available in the market at much lower prices.

Negative reviews and complaints

Before joining an MLM company, it is crucial to research online reviews and consumer complaints. Pay attention to consistent complaints about the quality of the products or the company’s business practices. Negative feedback and a high volume of complaints may indicate that the MLM company is operating as a pyramid scheme.

Product saturation in the market

Pyramid schemes often flood the market with their products, saturating it with an excessive supply. This saturation makes it extremely difficult for participants to sell the products and recoup their initial investments. If you notice that the market is already saturated with the MLM company’s products, it is a warning sign that the focus is on recruitment rather than genuine sales.

Overemphasis on Recruiting

Inadequate emphasis on selling products

A distinguishing characteristic of a pyramid scheme is the limited emphasis on selling products to actual customers. Instead, the primary focus is on recruiting new members and collecting enrollment fees from them. If the MLM company lacks a comprehensive strategy for selling products to external consumers, it may indicate that the primary source of income comes from recruitment rather than legitimate business transactions.

Pressure to recruit family and friends

Pyramid schemes often put immense pressure on participants to recruit their family and friends into the scheme. This pressure arises from the need to expand the network and generate more revenue through enrollment fees. If you find yourself being coerced or pressured to recruit your loved ones, it is a warning sign of a potential pyramid scheme.

Focus on recruitment bonuses and rewards

In a pyramid scheme, the compensation plan is heavily skewed towards recruitment bonuses and rewards, rather than actual sales commissions. The emphasis on recruitment incentives creates a false sense of earning potential, attracting individuals who are primarily motivated by the promise of financial gains through enrolling others. This focus on recruiting rather than product sales is a characteristic trait of a pyramid scheme.

Limited focus on product training

In a legitimate MLM company, adequate product training is essential to ensure that distributors can effectively promote and sell the products. However, in a pyramid scheme, the training provided is often minimal and focuses more on recruitment techniques rather than developing skills for successful product sales. If the MLM company lacks comprehensive product training or places greater importance on recruiting methods, it may indicate that it operates as a pyramid scheme.

Excessive Start-up Costs

Expensive enrollment fees

Pyramid schemes often require participants to pay expensive enrollment fees to join the scheme. These fees are typically much higher than the actual value of the products or services provided by the company. The primary purpose of these fees is to generate revenue for the scheme, rather than providing a legitimate business opportunity.

Mandatory initial product purchases

Some pyramid schemes force participants to make mandatory initial product purchases as a condition for joining the scheme. These purchases may be substantially more expensive compared to similar products available in the market. This requirement ensures that the pyramid scheme receives immediate income from new recruits, further augmenting the scheme’s financial sustainability.

Unfair inventory requirements

Pyramid schemes may impose unfair inventory requirements, forcing participants to maintain a certain level of product inventory at all times. These requirements often exceed the demands of genuine customers. By imposing these requirements, the scheme ensures a constant revenue stream from its participants, even if they have difficulty selling the products.

Hidden costs or ongoing expenses

In addition to the initial start-up costs, pyramid schemes may have hidden costs and ongoing expenses that participants are unaware of when joining. These hidden expenses can quickly accumulate, significantly impacting a participant’s financial well-being. If an MLM company is not transparent about all costs involved or fails to disclose potential ongoing expenses, it is a warning sign of a pyramid scheme.

Income Misrepresentation

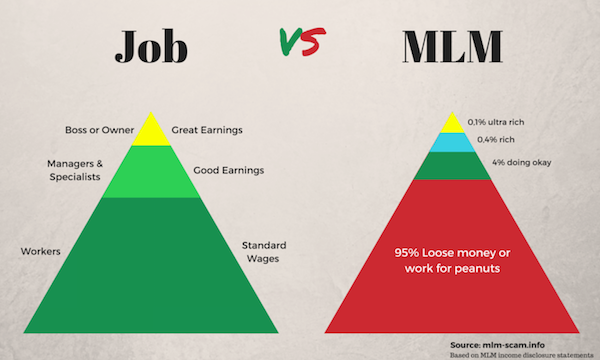

Promises of easy and quick wealth

A common tactic employed by pyramid schemes is to make false promises of easy and quick wealth. They typically portray the opportunity as a shortcut to financial success with minimal effort. However, in reality, achieving substantial income requires an unsustainable recruitment chain, ultimately leading to financial losses for the majority of participants.

Misleading income disclosures

Pyramid schemes may present income disclosures that are misleading or inaccurately represent the earnings potential. These disclosures often highlight exceptional income figures achieved by a small group of top earners, creating a false perception that these earnings are typical for all participants. If the MLM company’s income disclosures seem too good to be true or lack transparency, it could be a sign of a pyramid scheme.

Manipulation of income statistics

In some instances, pyramid schemes manipulate income statistics to create the illusion of profitability. They may fabricate earnings reports or manipulate the calculation methods to present inflated income figures, leading participants to believe that substantial wealth is easily attainable. Understanding the legitimacy of income statistics provided by an MLM company is crucial to identifying a potential pyramid scheme.

Lack of transparency in earning potential

Transparency in earning potential and a clear understanding of how income is generated are vital aspects of a legitimate business opportunity. However, pyramid schemes often lack transparency in their compensation plans and fail to provide a clear breakdown of how participants can earn income. If an MLM company is evasive or vague about the earning potential, it is wise to exercise caution and investigate further.

Aggressive Sales Tactics

High-pressure sales techniques

Pyramid schemes utilize high-pressure sales techniques to manipulate and deceive potential participants. These aggressive tactics often involve creating a sense of urgency or fear of missing out on a once-in-a-lifetime opportunity. By preying on individuals’ emotions, pyramid schemes aim to push them into making impulsive decisions without fully understanding the risks involved.

Recruitment-focused meetings

Meetings held by pyramid schemes are often heavily focused on recruitment rather than product promotion. The primary objective is to attract new participants by promising them financial freedom and extravagant lifestyle benefits. These meetings typically downplay the importance of selling products and instead emphasize the allure of building a large downline and earning passive income from recruits.

Manipulative persuasion strategies

Pyramid schemes employ manipulative persuasion strategies to convince individuals to join their ranks. They may exploit personal relationships and use guilt or emotional manipulation to persuade family and friends to become part of the scheme. These strategies are designed to exploit the trust and goodwill of potential participants for the scheme’s benefit.

Unethical marketing claims

To entice individuals into joining, pyramid schemes often make unethical marketing claims about the potential income and benefits of participation. These claims may include guarantees of substantial wealth, luxurious vacations, or lavish lifestyles. It is essential to critically evaluate these claims and consider them within the context of the MLM company’s overall operations and potential legal implications.

Lack of Support or Training

Insufficient guidance for new recruits

A significant drawback of pyramid schemes is the lack of sufficient guidance and support for new recruits. Genuine MLM companies recognize the importance of providing comprehensive training and ongoing support to distributors to help them succeed. However, in a pyramid scheme, the focus is solely on recruiting new members, often leaving recruits without the necessary knowledge and skills to effectively sell products or build a sustainable business.

Limited educational resources

Legitimate MLM companies invest in providing educational resources, including training materials, webinars, and workshops, to their distributors. These resources aim to enhance product knowledge, sales techniques, and overall business acumen. In a pyramid scheme, the lack of comprehensive educational resources is often evident, further indicating the scheme’s emphasis on recruitment rather than genuine business development.

Absence of mentorship programs

Mentorship programs are critical for the growth and success of individuals in the MLM industry. They provide guidance, support, and real-life experiences to help new recruits navigate the complexities of the business. A lack of mentorship programs within an MLM company suggests a focus on recruitment rather than fostering long-term success for participants.

Inadequate customer service

Legitimate MLM companies understand the importance of providing excellent customer service to ensure customer satisfaction and repeat business. However, pyramid schemes often neglect this aspect of the business, as their primary focus lies on recruitment rather than establishing a sustainable customer base. If an MLM company lacks robust customer service capabilities, it may indicate that the organization is operating as a pyramid scheme.

Complicated Compensation Plans

Confusing commission structures

Pyramid schemes often have convoluted compensation plans with complex commission structures that are difficult for participants to understand fully. These complicated plans can make it challenging to determine how earnings are calculated, leading to confusion and potential manipulation by the scheme’s operators. Additionally, the complexity of the compensation plan may be intentionally designed to prioritize recruitment over product sales.

Complex qualification requirements

In pyramid schemes, qualification requirements for earning commissions and bonuses are often intentionally complicated and difficult to achieve. This complexity serves as a barrier for participants to attain significant income, discouraging them from focusing on product sales and instead incentivizing them to concentrate on recruitment efforts. If the qualification requirements seem unreasonably complex or primarily revolve around recruitment, it could indicate a pyramid scheme.

Hidden clauses that limit earnings

Pyramid schemes may include hidden clauses within their compensation plans that place significant limitations on participants’ potential earnings. These hidden clauses can prevent participants from achieving the financial success they were promised, leaving them with minimal income despite their efforts. It is crucial to carefully review the compensation plan and identify any hidden clauses or restrictions before getting involved in an MLM company.

Difficulty in understanding payment processes

In a legitimate MLM company, the payment processes should be transparent and easy to understand. However, pyramid schemes often make payment systems unnecessarily complex to confuse participants and obscure the true nature of the scheme. If the payment processes seem overly complicated or lack transparency, it is a cause for concern and may indicate a pyramid scheme.

Legal Issues and Controversies

Lawsuits and legal battles

Pyramid schemes frequently face lawsuits and legal battles due to their fraudulent business practices. The legal implications can range from fines and settlements to criminal charges against the operators of the scheme. Researching an MLM company’s legal history and any ongoing legal battles is essential to avoid becoming involved in a potentially fraudulent scheme.

Federal Trade Commission (FTC) investigations

The Federal Trade Commission (FTC) is responsible for enforcing consumer protection laws in the United States. When the FTC investigates an MLM company and finds evidence of deceptive or unfair practices, it may take legal action against the company. If an MLM company has been subject to FTC investigations, it is a strong indication of potential pyramid scheme operations.

Negative media coverage and scandals

Media coverage and scandals related to an MLM company can provide valuable insights into its business practices and potential involvement in pyramid schemes. Negative stories, critical documentaries, or exposés may indicate fraudulent or unethical operations. Conducting thorough research and staying informed about any negative media coverage is crucial in avoiding pyramid schemes.

Associations with fraudulent individuals

Some MLM companies may have associations with individuals who have a history of fraud or involvement in illegal schemes. Researching the backgrounds of the company’s executives and leaders can help identify any potential red flags. If key figures within the MLM company have been associated with fraudulent activities in the past, it is a significant warning sign of a potential pyramid scheme.

Lack of Long-Term Sustainability

High attrition rates

Pyramid schemes typically experience high attrition rates, with participants dropping out or failing to renew their memberships over time. This high turnover is primarily attributed to the unsustainable nature of pyramid schemes, where the earnings heavily depend on continuously recruiting new members. The lack of long-term sustainability is a critical flaw in the business model of pyramid schemes.

Inability to adapt to market changes

Genuine MLM companies are adaptable and evolve with market trends to remain relevant and successful. In contrast, pyramid schemes often struggle to adapt to changing market conditions due to their inherent focus on recruitment rather than product innovation or development. The inability to respond to market changes and evolve may result in the scheme quickly losing popularity and sustainability.

Limited growth opportunities

Pyramid schemes inherently restrict growth opportunities for participants. As the scheme relies on recruiting an ever-expanding network of participants, the saturation point is eventually reached, making it significantly harder to find new recruits. This limitation on growth potential ultimately affects participants’ ability to increase their earnings and build a sustainable business.

Declining popularity or relevance

Pyramid schemes are often short-lived due to their fraudulent nature and unsustainable business practices. As public awareness about pyramid schemes increases, potential participants become more cautious, making it difficult for the scheme to attract new members. This decline in popularity and relevance can quickly lead to the collapse of the pyramid scheme, leaving participants with substantial losses.

Recognizing the warning signs, understanding the characteristics of pyramid schemes, and conducting thorough research are crucial steps in protecting yourself from falling victim to these fraudulent schemes. By staying informed and skeptical, you can avoid the financial and emotional consequences associated with pyramid schemes and make sound decisions in your pursuit of legitimate business opportunities.