In this article, you will learn about the differences between a Ponzi scheme and a pyramid scheme. We will take a closer look at how these two schemes operate, the key features that differentiate them from one another, and the potential risks and consequences they pose for individuals involved. By understanding the nuances between these two fraudulent schemes, you will be better equipped to protect yourself and make informed decisions.

Firstly, let’s understand what sets a Ponzi scheme apart from a pyramid scheme. While both schemes involve fraudulent investment operations, a Ponzi scheme typically involves a single person or organization that promises investors high returns on their investment. The returns are paid using funds obtained from new investors, rather than from any legitimate business or investment activity. On the other hand, a pyramid scheme operates by recruiting participants to invest or buy into a program, often promising large financial rewards for bringing in new recruits. These schemes rely on a constant inflow of new participants to sustain the payouts for earlier investors. It’s important to understand the distinctions between these two schemes to avoid falling victim to fraud and financial loss.

What is a Ponzi Scheme?

A Ponzi scheme is a fraudulent investment operation where the operator, often promising high returns with little to no risk, uses funds from new investors to pay returns to earlier investors. The scheme is named after Charles Ponzi, an Italian immigrant who became notorious for running one of the first and most infamous Ponzi schemes in the 1920s. Ponzi schemes are based on the principle of robbing Peter to pay Paul, relying on a continuous influx of new investors to sustain the operations.

Definition of Ponzi Scheme

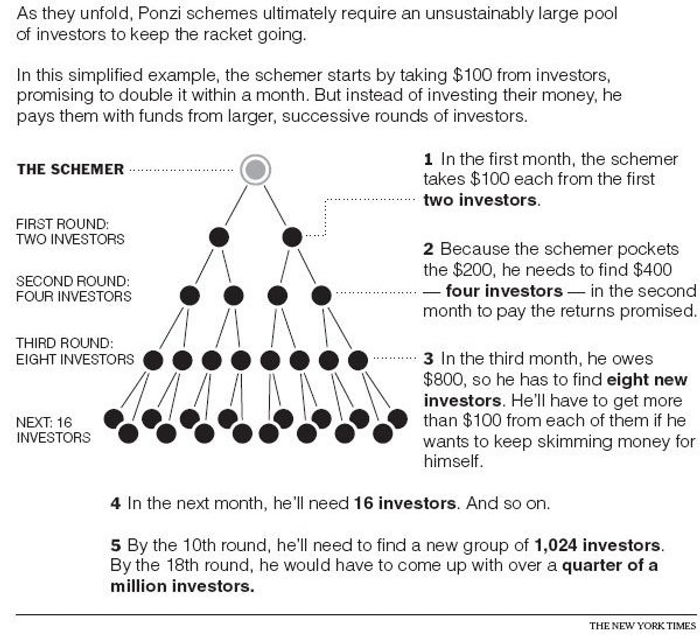

A Ponzi scheme is a type of investment fraud that involves paying returns to existing investors using funds contributed by new investors, rather than generating legitimate profits. The scheme is often based on promises of high and consistent returns, with little or no risk. However, the returns are not generated through legitimate means, such as profitable investments, but rather through the influx of new investor funds. As a result, the scheme collapses when the number of new investors diminishes, and there is no longer enough money to pay the promised returns.

Origins of Ponzi Scheme

The history of Ponzi schemes can be traced back to the early 20th century, when Charles Ponzi, a charismatic Italian immigrant, devised a scheme that promised high returns on international postal reply coupons. Ponzi claimed to have discovered an arbitrage opportunity, buying these coupons cheaply in one country and redeeming them for a higher value in another country. Although the scheme initially attracted investors with its promise of quick, easy profits, it eventually unraveled, and Ponzi was exposed as a fraud. His scheme collapsed in 1920, resulting in significant financial losses for his investors.

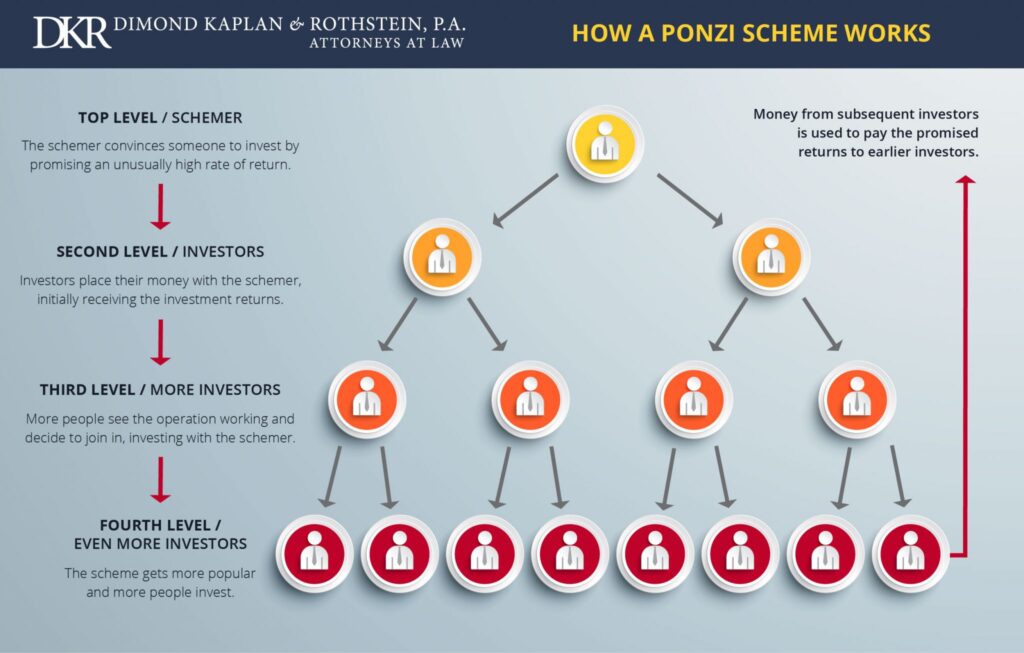

How Ponzi Scheme Works

Ponzi schemes typically involve an individual or a group of individuals who pose as legitimate investment managers or advisors. They often target individuals and communities with promises of high returns and little risk. The operators of the scheme use the funds contributed by new investors to pay the promised returns to earlier investors. This creates the illusion of successful investments and attracts more investors to join the scheme. However, in reality, no legitimate investment activities are taking place, and the returns are solely dependent on the continuous influx of new investor funds. As the scheme grows, it becomes increasingly difficult to sustain, and it eventually collapses once the number of new investors dwindles.

Characteristics of Ponzi Scheme

Ponzi schemes share several common characteristics that can help identify and differentiate them from legitimate investment opportunities. These characteristics include:

-

Unrealistic Returns: Ponzi schemes often promise abnormally high and consistent returns that are not achievable through legitimate means.

-

Unregistered Investments: Ponzi schemes are often not registered with regulatory authorities, as they operate outside the bounds of legitimate investment practices.

-

Lack of Transparency: Ponzi schemes typically lack transparency in their operations, making it difficult for investors to fully understand how their money is being used.

-

Overemphasis on Recruitment: Ponzi schemes heavily rely on recruiting new investors to sustain the operations and pay returns to previous investors.

-

Promises of Little or No Risk: Ponzi schemes often claim to offer high returns with little to no risk, which is a red flag in the investment world, as all investments carry some level of risk.

-

Payouts from Principal: In many Ponzi schemes, the initial returns paid to investors are funded using their own invested capital rather than actual profits.

Famous Ponzi Schemes

Over the years, several high-profile Ponzi schemes have made headlines and caused significant financial losses for investors. Understanding these famous Ponzi schemes can shed light on how they operated and the impact they had on the financial landscape. Here are three notable examples:

Charles Ponzi’s Scheme

Charles Ponzi’s scheme, which gave rise to the term “Ponzi scheme,” involved the fraudulent trading of international postal reply coupons. Ponzi promised investors a 50% return on their investment in just 45 days or a 100% return within 90 days. He attracted a large number of investors, including prominent individuals and even financial institutions. However, it was later revealed that Ponzi was not actually buying and selling the coupons as he claimed, and his scheme collapsed, resulting in substantial losses for his investors.

Bernard Madoff’s Scheme

Arguably the most notorious Ponzi scheme in history, Bernard Madoff’s scheme involved a staggering $65 billion fraud. Madoff, a former chairman of the NASDAQ stock exchange and respected investor, claimed to have consistently generated high returns through a complex strategy. However, it was eventually discovered that Madoff was using funds from new investors to pay returns to existing investors, and no legitimate investments were being made. Madoff’s scheme collapsed in 2008 during the global financial crisis, causing massive losses for individuals, charities, and financial institutions.

Allen Stanford’s Scheme

Allen Stanford, a Texas billionaire, orchestrated a Ponzi scheme through his offshore bank, Stanford International Bank (SIB). He promised investors high returns on certificates of deposit (CDs) issued by SIB. However, the funds were not invested as promised, and instead, Stanford misappropriated the funds for personal use and to sustain the scheme. The scheme collapsed in 2009 when the U.S. Securities and Exchange Commission (SEC) exposed the fraud, leading to significant losses for investors.

Legal Consequences of Ponzi Scheme

Ponzi schemes are illegal and carry severe legal consequences for those involved in their operation. The legal consequences can be both criminal and civil in nature, and they often involve significant financial penalties, jail sentences, and the forfeiture of assets.

Criminal Charges

The operators of Ponzi schemes can face various criminal charges, depending on the jurisdiction and the specific circumstances of the case. These charges may include fraud, securities fraud, money laundering, and conspiracy, among others. If convicted, individuals can be sentenced to lengthy prison terms and substantial fines.

Civil Lawsuits

In addition to criminal charges, victims of Ponzi schemes can also pursue civil lawsuits against the operators, seeking financial compensation for their losses. These lawsuits can result in judgments or settlements that require the fraudulent operators to repay the investors, although recovery of funds is often limited and depends on the availability of assets.

Losses and Recovery

One of the unfortunate aspects of Ponzi schemes is that investors often face significant financial losses and may only be able to recover a fraction of their initial investments, if anything at all. Recovery efforts are generally conducted by court-appointed receivers or trustees who work to identify and liquidate assets linked to the scheme. However, the complexity of these cases, as well as the difficulty of tracing and recovering funds, can make the process lengthy and challenging.

Victims of Ponzi Scheme

Ponzi schemes can have devastating impacts on the lives of their victims, who often suffer financial losses, emotional distress, and other negative consequences. Understanding the types of victims, the psychological effects they experience, and the support available for them is crucial in addressing the aftermath of these fraudulent schemes.

Types of Victims

Victims of Ponzi schemes can include individuals from all walks of life, ranging from ordinary individuals to high-net-worth individuals, charitable organizations, and even financial institutions. The allure of high returns with little risk can be enticing to anyone and may lead individuals to invest their hard-earned savings or even borrow money to participate in the scheme.

Psychological Effects

The psychological impact on victims of Ponzi schemes can be profound and long-lasting. Besides the obvious financial losses, victims may experience a range of emotions such as anger, betrayal, shame, and guilt. The collapse of a Ponzi scheme can also disrupt individuals’ financial stability and personal relationships, leading to stress, anxiety, and depression.

Support for Victims

Various organizations and initiatives exist to support victims of Ponzi schemes and help them navigate the legal, emotional, and financial challenges they face. These include victim assistance programs provided by government agencies, support groups, legal aid services, and financial counseling. The goal is to provide victims with the necessary resources and support to recover from the scheme and rebuild their lives.

What is a Pyramid Scheme?

A pyramid scheme, much like a Ponzi scheme, is a fraudulent investment operation that relies on the recruitment of new participants to sustain payouts to earlier participants. However, there are distinctive characteristics that distinguish pyramid schemes from Ponzi schemes.

Definition of Pyramid Scheme

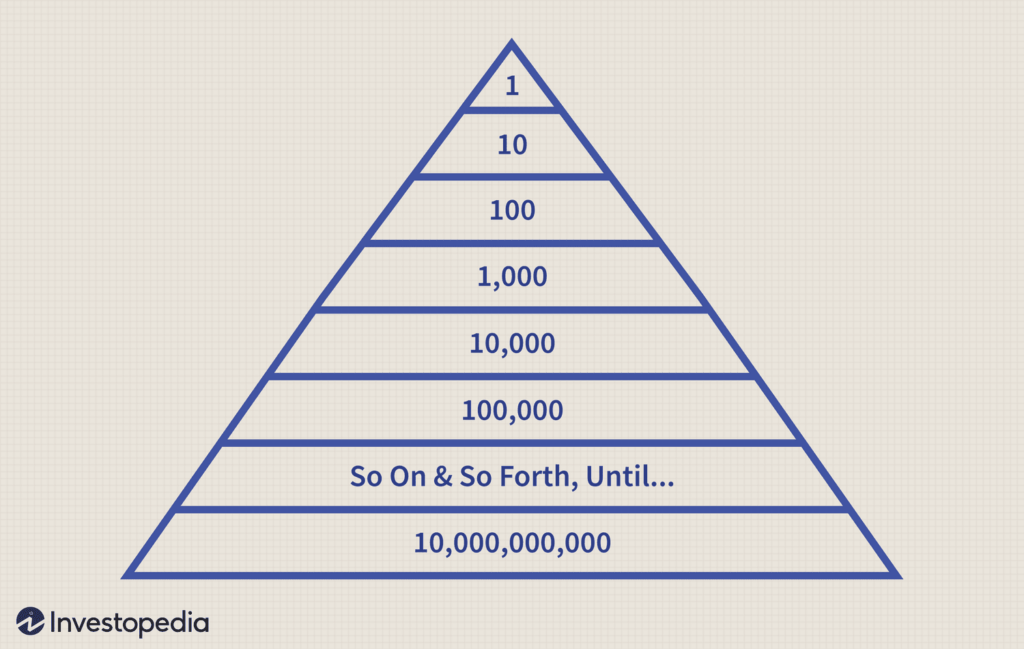

A pyramid scheme is a fraudulent business model that promises participants payment or other benefits primarily for enrolling others into the scheme rather than selling a genuine product or service. Participants typically make a monetary investment to join the scheme and are then encouraged to recruit others. As more participants join, the scheme expands, and those higher up the pyramid receive payments derived from the investments of new recruits. Eventually, as the pool of potential recruits dries up, the scheme collapses, leaving the majority of participants with financial losses.

Comparison with Ponzi Scheme

While both Ponzi schemes and pyramid schemes involve a fraudulent scheme that relies on a continuous influx of new participants, there are notable differences between the two.

One key difference is that Ponzi schemes typically involve the promise of financial returns generated through investments, whereas pyramid schemes focus on recruiting participants and building a hierarchical structure. Additionally, in Ponzi schemes, earlier participants are paid using funds from new participants, while pyramid schemes primarily rely on the recruitment of new participants to generate payouts to those higher up in the scheme.

How Pyramid Scheme Works

Pyramid schemes often begin with a small group of individuals at the top, who recruit others to join the scheme. These recruits, known as the second level, then recruit additional participants, creating a multi-level structure. Each participant is required to make a monetary investment upon joining, which is used to pay the individuals above them in the pyramid. As the scheme grows, participants at the top receive multiple payments from participants below them, while those lower down struggle to recruit new participants and recoup their initial investment.

Structural Elements of Pyramid Scheme

Pyramid schemes typically exhibit several structural elements that help distinguish them from legitimate business models. These elements include:

-

Focus on Recruitment: Pyramid schemes place a heavy emphasis on participant recruitment, with the promise of financial rewards for enrolling others into the scheme.

-

Lack of Product or Service: Pyramid schemes often lack a genuine product or service that participants sell to generate revenue. Instead, the focus is on recruiting new participants.

-

Hierarchical Structure: Pyramid schemes have a hierarchical structure, with participants at the top benefiting most from the recruitment efforts of those below them.

-

Limited Earnings Potential: Pyramid schemes offer limited earnings potential for most participants, as the market for new recruits eventually becomes saturated.

Famous Pyramid Schemes

As with Ponzi schemes, there have been notable pyramid schemes that have garnered attention due to their size and impact on participants. While pyramid schemes may not always reach the same level of infamy as Ponzi schemes, they can still cause significant financial losses. Here are three famous examples:

The Bernie Madoff’s Scheme

While Bernie Madoff’s fraudulent activities are often associated with his Ponzi scheme, he also operated a pyramid-like structure within his investment advisory business. Madoff encouraged his clients to refer new investors, offering them incentives or reduced fees. The referral program resembled a pyramid scheme, with those at the top benefiting from the efforts of those below them.

The Herbalife Case

Herbalife, a multi-level marketing company, became embroiled in controversy and legal battles when it was accused of operating as a pyramid scheme. The accusations stemmed from allegations that the company’s compensation structure primarily rewarded participants for recruiting new members rather than selling the company’s products. After a lengthy investigation and legal proceedings, Herbalife reached a settlement with the Federal Trade Commission (FTC) in 2016, requiring significant changes to its business practices.

The ZeekRewards Case

ZeekRewards, an online penny auction website, operated a scheme that combined elements of a Ponzi scheme and a pyramid scheme. Participants were encouraged to invest in “VIP bids” with the promise of daily returns on their investments. The scheme collapsed in 2012 when the U.S. Securities and Exchange Commission (SEC) intervened, revealing the fraudulent nature of the operations. The scheme had attracted over a million participants and caused substantial financial losses.

Legal Consequences of Pyramid Scheme

As with Ponzi schemes, pyramid schemes are illegal in most jurisdictions, and those involved in their operation can face significant legal consequences. These consequences can include criminal charges, civil lawsuits, and government actions.

Federal Laws and Regulations

Pyramid schemes are often subject to federal laws and regulations that prohibit deceptive business practices. In the United States, for example, the FTC enforces regulations related to pyramid schemes and has taken legal action against companies found to be operating as pyramid schemes. Individuals involved in pyramid schemes can face criminal charges, fines, and other penalties.

Impact on Participants

Participants in pyramid schemes can suffer substantial financial losses, often losing their initial investments and any additional funds they may have invested in the scheme. Unlike Ponzi schemes, where earlier participants may receive some returns before the collapse, pyramid schemes tend to result in losses for the majority of participants.

Government Actions

Government agencies, such as the FTC and the SEC, actively monitor and investigate pyramid schemes and take legal action against operators. These agencies aim to protect consumers and maintain the integrity of the financial system by identifying and shutting down fraudulent schemes. When pyramid schemes are exposed, the government may seek injunctions, freeze assets, and pursue legal remedies to prevent further harm to participants.

Prevention and Detection

Preventing and detecting Ponzi schemes and pyramid schemes is essential to protect individuals from falling victim to these fraudulent schemes. Several measures can help mitigate the risk and raise awareness.

Regulatory Measures

Regulatory bodies play a crucial role in preventing and detecting Ponzi schemes and pyramid schemes by enforcing laws and regulations governing investment activities. Agencies such as the SEC, the FTC, and other financial regulators are responsible for monitoring investment schemes, investigating suspicious activities, and taking legal action against fraudulent operators.

Educating the Public

Public education is vital in preventing individuals from becoming victims of Ponzi schemes and pyramid schemes. Providing information about common fraud schemes, warning signs to watch out for, and ways to verify the legitimacy of investments can help individuals make informed decisions and avoid falling prey to fraudulent schemes.

Fraud Warning Signs

Understanding the warning signs of Ponzi schemes and pyramid schemes is crucial in detecting and avoiding these fraudulent schemes. Some common red flags include:

-

Unrealistic and consistent returns: If an investment opportunity promises unreasonably high and consistent returns with little or no risk, it should be treated with skepticism.

-

Lack of transparency: Legitimate investment opportunities should provide clear and transparent information about the investment strategy, risks, and financial statements. If such information is missing or difficult to obtain, it may be a red flag.

-

Pressure to recruit: Pyramid schemes often place a significant emphasis on recruiting new participants. If an investment opportunity relies heavily on recruitment, it is essential to investigate further.

-

Lack of regulatory oversight: Ponzi schemes and pyramid schemes often operate outside the bounds of legitimate investment practices and may not be registered or regulated. Checking the registration status of an investment opportunity can provide valuable information.

Difference Between Ponzi Scheme and Pyramid Scheme

While Ponzi schemes and pyramid schemes share some similarities, they also have key differences that distinguish them from each other. Understanding these differences is crucial to recognizing and avoiding these fraudulent schemes.

Key Differentiating Factors

One of the primary differences between Ponzi schemes and pyramid schemes lies in their underlying structure. Ponzi schemes focus on using new investor funds to pay returns to earlier investors, while pyramid schemes primarily rely on participant recruitment to generate payouts. Additionally, Ponzi schemes often promise investment returns, whereas pyramid schemes may falsely market products or services along with the recruitment efforts.

Similarities and Overlaps

Despite their differences, Ponzi schemes and pyramid schemes do share commonalities. Both schemes involve fraudulent activities, deceive investors, and rely on a continuous influx of new participants to sustain the scheme. Moreover, the collapse of both types of schemes can result in significant financial losses for the majority of participants.

Risk Factors

Investors should be aware of the risk factors associated with Ponzi schemes and pyramid schemes to protect themselves from potential financial harm. Some key risk factors to consider include:

-

Unreasonable promises: Investment opportunities that offer unrealistic returns with minimal risk should be met with skepticism.

-

Lack of transparency: If an investment opportunity lacks transparency and fails to provide detailed information about its operations, investment strategy, and financial statements, it may be a warning sign.

-

Pressure to recruit: Pyramid schemes often place significant emphasis on recruiting new participants. If an investment opportunity heavily focuses on recruitment rather than generating legitimate profits, it should be approached with caution.

Conclusion

Understanding Ponzi schemes and pyramid schemes is crucial in protecting yourself from falling victim to fraudulent investment schemes. Both schemes operate by deceiving investors and relying on a continuous influx of new participants. Ponzi schemes promise high returns through investments, while pyramid schemes primarily focus on participant recruitment. By being aware of the red flags, seeking information, and staying informed about the latest fraud prevention measures, you can reduce the risk of becoming a victim. Protect yourself by being cautious, conducting due diligence, and seeking professional advice before investing your hard-earned money. Stay vigilant, be aware of the warning signs, and report any suspicious activities to the appropriate authorities. By staying informed and alert, you can safeguard your financial well-being and ensure your investments are legitimate and secure.